what is a closed tax lot report

Our Tax Reporting web pages include a wealth of important tax-related information including. With Closed Tax Lots you can track the following information for each security you currently.

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

In our example above we sold 20 shares of Company XYZ for 10 per share.

. Finally the tax lot includes the sale price of the securities in the lot. Every time you sell shares a Closed Tax Lot is created to track the date and price of your sale. What is a closed tax lot Report.

A list of all tax forms and reports for the current tax year with links to the actual PDF forms. The Closed Lots view provides cost basis and gainloss information for all lots that were closed in the position. Your capital gain or loss is equal to the difference between the assets cost basis and the sales price of the closing transaction.

A tax-lot relief method is used to determine. Every time you sell shares a Closed Tax Lot is created to track the date and price of your sale. If available gainloss information is provided for closed lots that.

A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices and. You may want to exclude money market funds because they have no gains or losses. For married folks filing jointly its 501600.

With closed tax lots you can track the. Every time you sell shares a closed tax lot is created to track the date and price of your sale. By comparing the sale price to the cost basis you and the IRS make an accurate determination on the profits.

Tax Lot Accounting. A record keeping technique that traces the dates of purchase and sale cost basis and transaction size for each security in your portfolio even if you make. Tax lot accounting is important because it helps investors minimize their capital gains taxes.

The tax rate on long-term capital gains tops out at 20 for single filers who report over 445850 or more in income in 2021. With Closed Tax Lots you can track the following information for each security you currently. With closed tax lots you can track the following information for each security you currently.

Every time you sell shares a closed tax lot is created to track the date and price of your sale. What is a closed tax lot report Sunday July 31 2022 Edit By definition cost basis is the original value of a stock investment or any asset adjusted for stock splits certain types of. Set up an Investing Portfolio view that includes the securities and columns you are interested in.

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

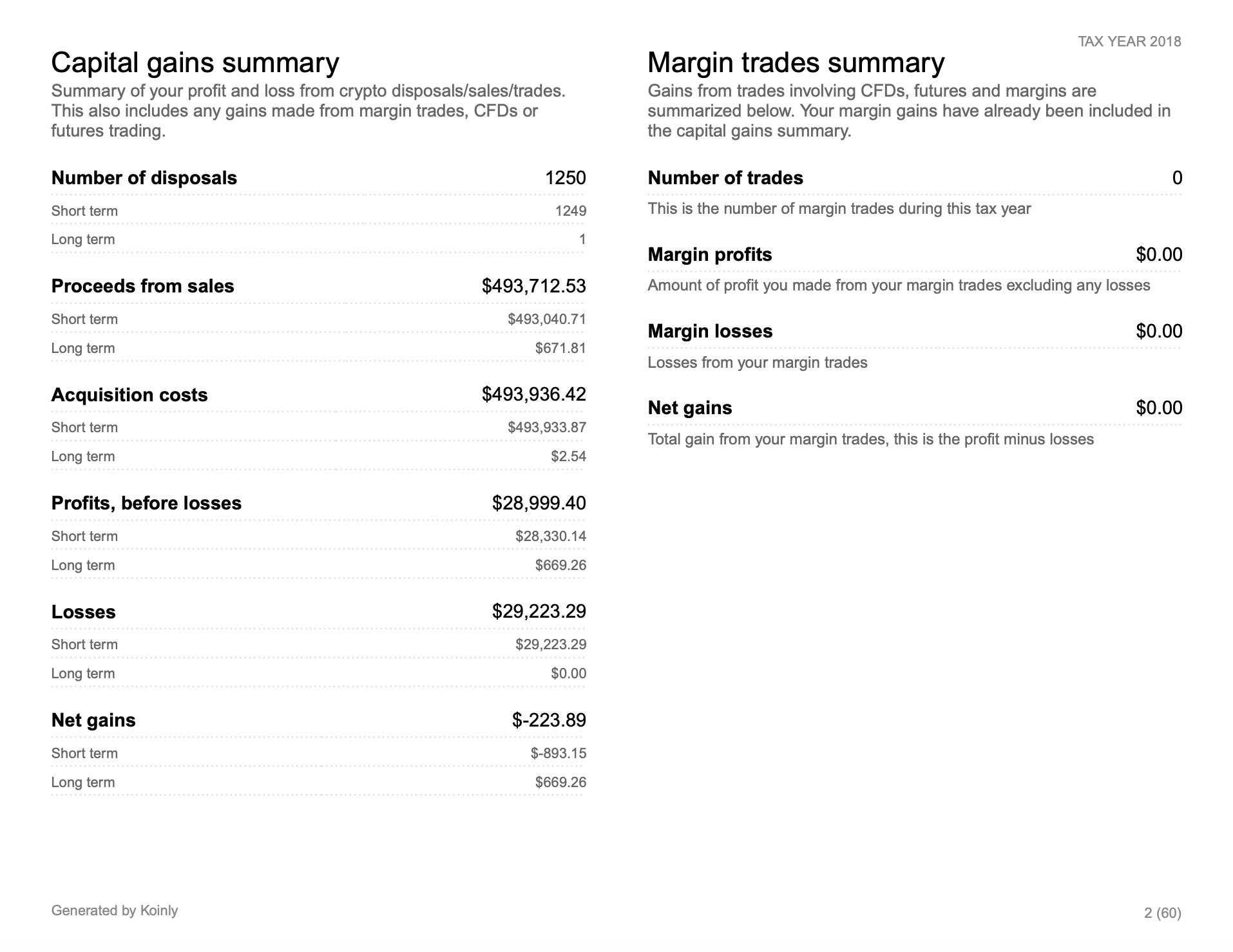

Crypto Tax Profit And Loss Explained Koinly

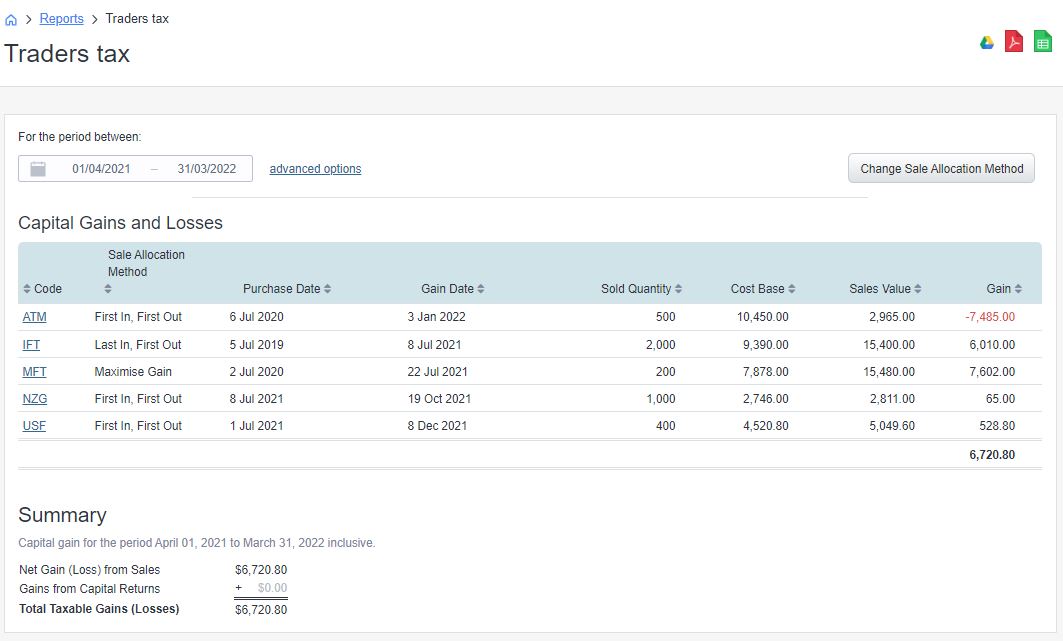

Calculating Taxable Gains On Share Trading In New Zealand

Definition What Is A Tax Return Tax Return Tax Tax Services

Browse Our Example Of Rental Security Deposit Refund Form Being A Landlord Deposit Certificate Of Deposit

Start Off The New Year With Clean Books Preparing For Year End Clean Book Financial Checklist Preparation

Facility Maintenance Plan Template Beautiful 12 13 School Maintenance Plan T Simple Business Plan Template Preventive Maintenance Retail Business Plan Template

Share Your Tax Issues With Us Tax Services Tax Refund Tax Preparation

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Tax Client Information Sheet Template Google Docs Word Apple Pages Pdf Template Net Card Templates Templates Report Card Template

Accounting Equation Chart Cheat Sheet In 2022 Accounting Payroll Accounting Accounting Basics

The Complete Binance Tax Reporting Guide Koinly

5 Investment Tax Mistakes To Avoid Tax Mistakes Investing Tax Preparation

Journal Entry For Depreciation Accounting Notes Accounting Principles Journal Entries

Board Of Directors Report Template Elegant Download Example Ceo Report To Board Directors Template Report Template Meeting Agenda Template Board Of Directors

The Complete Binance Tax Reporting Guide Koinly

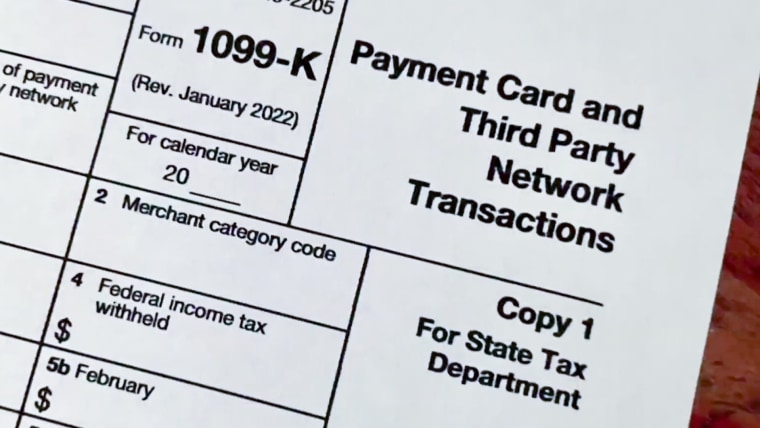

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)